Munich Business School Empowerment Fund

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

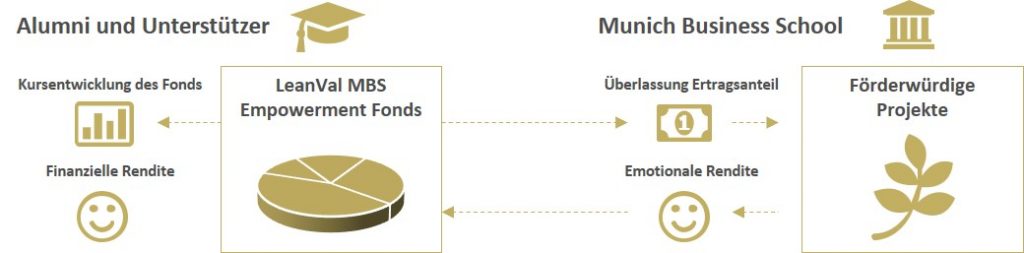

New ways of promoting universities

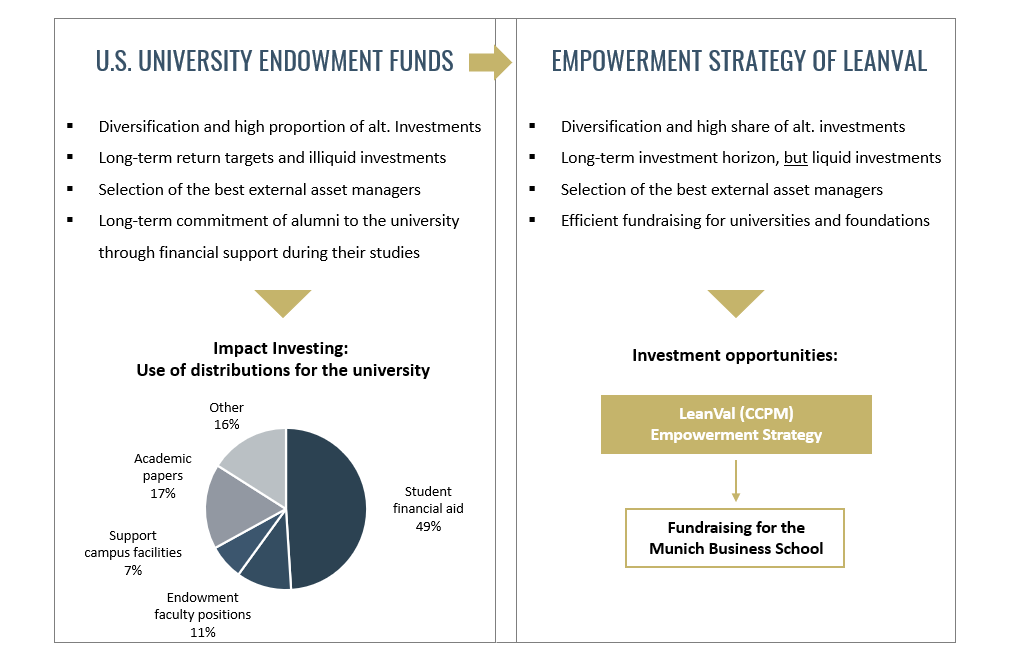

As a private university, MBS is looking for new ways to fund scholarships and projects. In raising such funds, the elite U.S. universities with their university funds are a model for us.

These so-called endowments are a typical form of university funding in the Anglo-Saxon world. Harvard founded the Harvard Management Company back in 1974. Here, the university invests donated capital on its own and invests it for profit. The return on capital generated is then used to finance projects and the ongoing operations of the university. Today, this fund represents one of the largest endowments in the world, at around US$40 billion (2019).

Following this concept, the Empowerment Fund was established.

The English term empowerment can be translated as to empower, strengthen and enable. Funding scholarships and projects from the fund is intended to strengthen our students and the university in general. At the same time, the exchange between the university and its supporters is to be intensified.

Double profit through impact-oriented investing

In addition to generating a stable return over the long term, the concept also allows parts of the income to be transferred to Munich Business School. In keeping with the concept of endowment, the invested capital is used to finance charitable projects.

The main difference to donations to organizations or foundations lies in the fact that the capital is only provided temporarily, and can be reclaimed easily by selling the fund units if required. Legally, the donor thus remains a shareholder in the fund and can dispose of its capital at any time.

Why a new fund?

In addition to generating a stable return over the long term, the concept also allows parts of the income to be transferred to Munich Business School. In keeping with the concept of endowment, the invested capital is used to finance charitable projects.

The main difference to donations to organizations or foundations lies in the fact that the capital is only provided temporarily, and can be reclaimed easily by selling the fund units if required. Legally, the donor thus remains a shareholder in the fund and can dispose of its capital at any time.

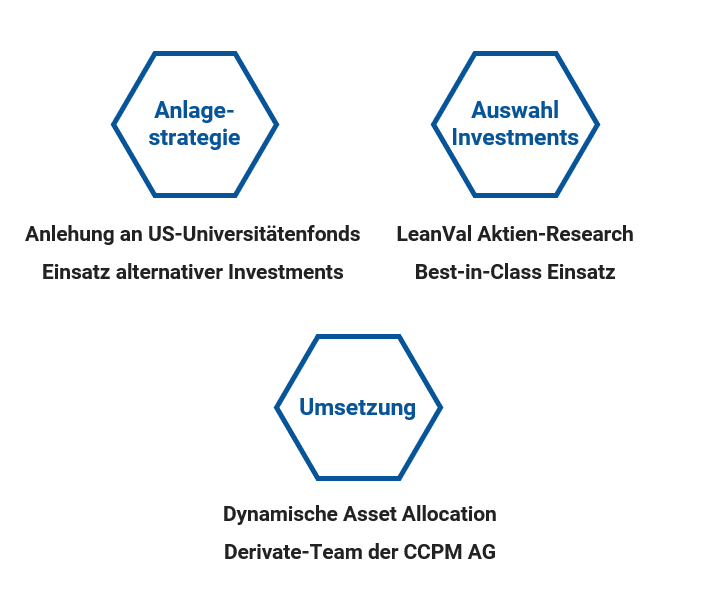

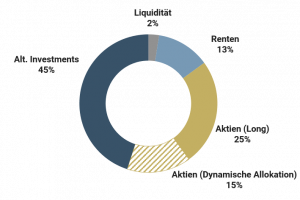

The "signature" of the portfolio

We decided to design a portfolio beyond classic investment strategies. A strategy that can take advantage of the earning power of stocks, but whose risks are limited by using alternative strategies. The weighting of the individual portfolio components is based on the successful endowment concept of US universities. Since Germany has stricter regulations on investments than the U.S., we have extensively modified the U.S. endowment approach. However, the advantages of broadly diversified asset allocation are retained and risks are minimized.

The asset classes

Strategic Asset Allocation

The weighting of the asset classes is based on the asset allocation of the major U.S. unifunds. The investment horizon is long-term and the portfolio may therefore be subject to medium asset fluctuations.

Bonds

Bond investments are significantly underweighted compared to traditional concepts. Due to the low interest rates, they offer hardly any earnings potential and can no longer be regarded as a security anchor in the portfolio. This function is performed by Dynamic Asset Allocation and Alternative Investments.

Equities

On the one hand, this asset class consists of broadly diversified international equity investments. In addition to the equity expertise of the LeanVal research team, we draw on the world’s best external managers, evaluated by our cooperation partner ffex.

On the other hand, we use a put strategy as Dynamic Asset Allocation, which is managed by our derivatives team.

Alternative Investments

This group of investments plays the central role in the portfolio. The absolute return strategies take over the function of risk diversification in the portfolio. The market neutral strategies, private equity and real estate investments contribute the returns.

The partner

Innovative fundraising concept for Munich Business School

Universities in the U.S. have a long tradition of attracting external funding. Thanks to the support of a strong alumni network, they now have a billion-dollar endowment. These assets are used, among other things, to award scholarships, fund research positions, and defray ongoing costs of university operations.

In Germany, too, alumni and other sponsors are showing increasing interest in providing financial support to universities. The well-known endowment or gift is a form of permanent transfer of assets. Donors must overcome an internal hurdle in this process because “ownership” of the principal is transferred to the university and retrieval is virtually impossible. The Empowerment Fund offers a real alternative to this.

Munich Business School was won as the first partner for the new fund concept. Munich Business School, a state-recognized private business school in Munich accredited by the German Council of Science and Humanities, has been offering cosmopolitan, entrepreneurial personalities an inspiring and international academic environment to develop into responsible leaders of tomorrow for more than 25 years.

Munich Business School impresses with its award-winning programs: Students can lay the foundation for their career with the Bachelor International Business and focus on their individual preferences with one of the Master programs – Master International Business, Master Innovation and Entrepreneurship, Master International Marketing and Brand Management or Master Sports Business and Communication. With the MBA General Management – full-time or part-time – experienced professionals advance their careers. In addition, Munich Business School offers various seminars and courses as part of its executive education program to support the professional development and continuing education of specialists and managers.

Innovative fundraising concept for the Munich Business School

Universities in the USA have a long tradition of attracting external funding. Thanks to the support of a strong alumni network, they now have endowment assets worth billions. These assets are used, among other things, to award scholarships, finance research positions and cover the running costs of university operations.

In Germany, too, alumni and other sponsors are showing increasing interest in providing financial support to universities. The well-known donation or gifting is a form of permanent transfer of assets. The donors have to overcome an internal hurdle, because the “ownership” of the capital is transferred to the university and retrieval is virtually impossible. The Empowerment Fund now offers a real alternative to that issue.

The Munich Business School has been won as the first partner for the new fund concept. For more than 25 years, Munich Business School, a state-accredited and German Council of Science and Humanities-accredited private university for business in Munich, has been offering globally minded, entrepreneurial personalities an inspiring and international academic environment to develop into the responsible leaders of tomorrow.

Munich Business School’s award-winning programs are impressive: Students can lay the foundation for their career with the Bachelor International Business and focus on their individual preferences with one of the Master’s programs – Master International Business, Master Innovation and Entrepreneurship, Master International Marketing and Brand Management or Master Sports Business and Communication. With the MBA General Management – full-time or part-time -, experienced professionals advance their career, the icing on the cake is the DBA Doctorate Program. In addition, Munich Business School offers various seminars and courses as part of its Executive Education program to support the professional development of specialists and managers.

Recovery of the capital employed at any time

The investor can easily dispose of the capital if required by selling the fund units. Subscriptions from alumni and those close to the university will be used to fund scholarships and community service projects in the area of the university. At the same time, this is intended to intensify the dialog between Munich Business School and its supporters. The concept is rounded off by reporting that goes beyond purely financial aspects such as fund performance.

Investors gain insight into the selection of funded projects through ongoing information. Thus, in addition to the financial return, the investor also receives an emotional return for his commitment.

Retrieval of the invested capital at any time

The investor can easily dispose of the capital by selling the fund units if necessary. Subscriptions by alumni and persons close to the university are to be used to finance scholarships and charitable projects in the area of the university. At the same time, this is intended to intensify the dialog between Munich Business School and its supporters.

The concept is rounded off by a detailed reporting that goes beyond purely financial aspects such as fund performance.

Ongoing information provides investors with insights into the selection of projects supported. Thus, in addition to the financial return, the investor also receives an emotional return for his commitment.

Service Provider

Investment Manager:

LeanVal Asset Management AG

Bleichstraße 52

60313 Frankfurt am Main

Capital Management Company:

HANSAINVEST Hanseatische Investment-GmbH (HI)

Depository:

Cologne District Savings Bank

Investment Opportunities

Liquidity:

Daily

WKN:

MBS Class: A2PYPG

ISIN:

MBS Class: DE000A2PYPG7

Minimum investment:

1 fund share

Share price:

EUR 100.00 at the issue date April 15, 2020

Fees

Depositary fee:

max. 0.25% p.a.

Management fee:

MBS class: 2.50% p.a. (LVAM) + 0.20% p.a. (HI)

Profit sharing:

20% with High Watermark and 4% Hurdle Rate

Fund platforms and points of sale

The Empowerment Fund can be subscribed via the usual fund platforms or sales outlets.

Contact

Axel Gauss

+49 69 9494 88 022 Axel.Gauss@lvam.de

Thomas Hunger

+49 69 9494 88 041 Thomas.Hunger@lvam.de